KEY TAKEAWAYS:

- Gold Hits Record Highs: As of April 2025, gold prices have surged to over $3,300 per ounce, driven by economic uncertainties and geopolitical tensions.

- Central Banks Boost Reserves: In 2024, central banks added 1,045 tonnes to global gold reserves, marking the third consecutive year of significant purchases. World Gold Council

- Hedge Funds See Strong Returns: Greenlight Capital reported an 8.2% gain in Q1 2025, attributing success to investments in physical gold and call options.

- Analysts Predict Further Growth: Goldman Sachs raised its end-2025 gold price forecast to $3,700 per ounce, citing strong demand and market conditions.

- Gold Enhances Portfolio Diversification: Incorporating gold into investment portfolios can provide a hedge against inflation and reduce overall risk due to its low correlation with other assets.

As of April 2025, gold has surged to record highs, capturing the attention of investors worldwide. With escalating geopolitical tensions, economic uncertainties, and shifting monetary policies, many are considering gold as a potential safe-haven asset. But is now the right time to invest in gold? Let’s delve into 30 compelling facts and figures that shed light on this question.

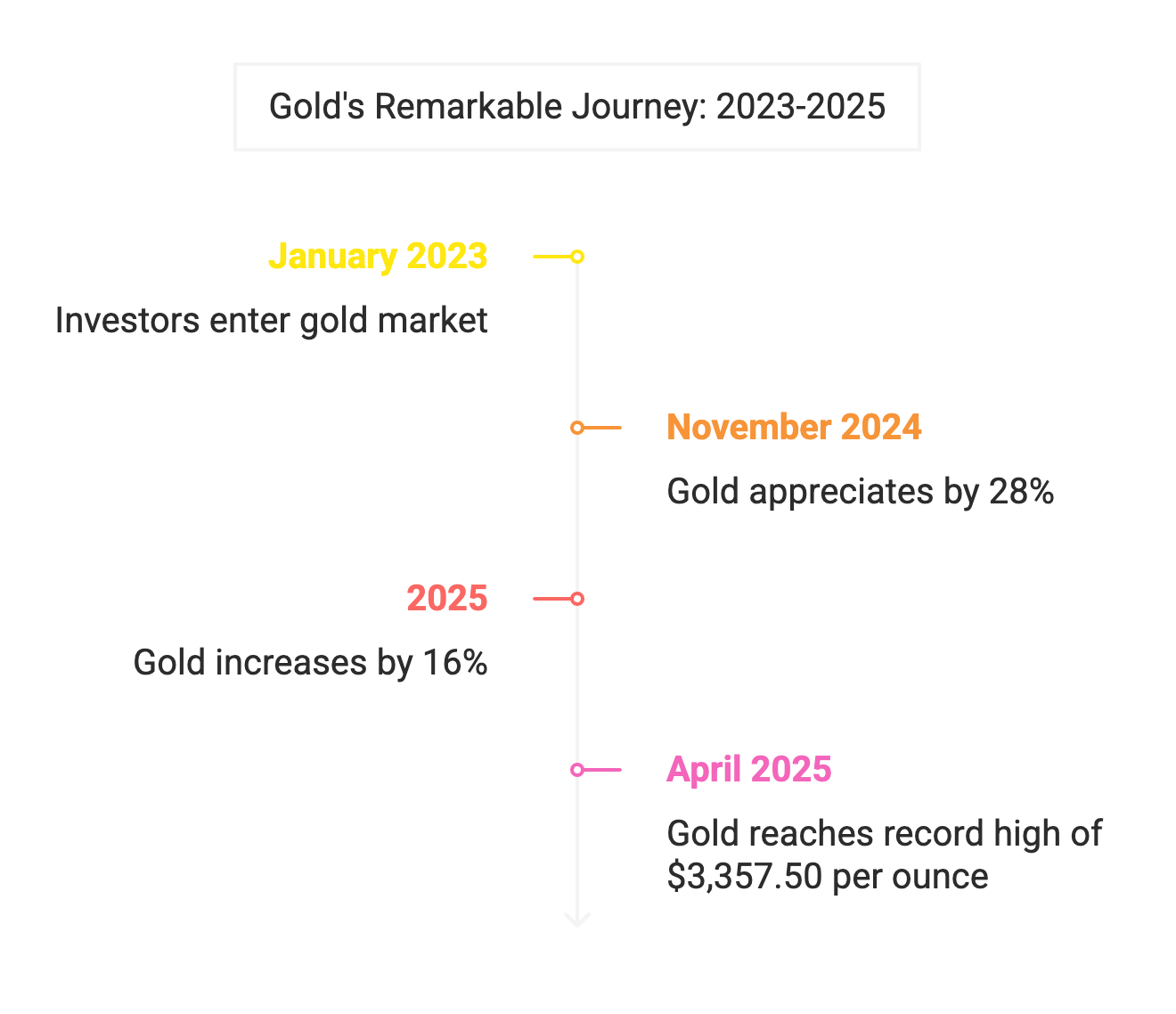

Gold’s Stellar Performance

- Record Highs: Gold prices soared to an all-time high of $3,357.50 per ounce in April 2025, reflecting a significant uptick in investor demand.

- Impressive Returns: Since November 2024, gold has appreciated by approximately 28%, showcasing its resilience amid market volatility.

- Long-Term Growth: Investors who entered the gold market at the beginning of 2023 have witnessed returns nearing 68% by March 2025.

- Consistent Uptrend: In 2025 alone, gold has experienced a 16% increase, building upon a 27% rise in 2024.

Central Bank & Institutional Demand

- Central Bank Purchases: In 2024, central banks added a net 1,045 tonnes to global gold reserves, marking the third consecutive year of purchases exceeding 1,000 tonnes.

- China’s Accumulation: The People’s Bank of China resumed gold purchases in November 2024, contributing to a significant portion of global demand.

- U.S. Holdings: The United States maintains the largest gold reserves globally, totaling over 8,133 metric tons, accounting for approximately 75% of its foreign exchange reserves.

Investment Strategies & Hedge Fund Activity

- Hedge Fund Success: Greenlight Capital reported an 8.2% gain in Q1 2025, attributing its success to strategic investments in gold.

- Portfolio Diversification: The fund’s approach included holdings in physical gold and call options, capitalizing on rising inflation expectations.

Analyst Forecasts for 2025 and Beyond

- Goldman Sachs: Raised its end-2025 gold price forecast to $3,700 per ounce, citing stronger-than-expected ETF inflows and sustained central bank demand.

- UBS & Bank of America: Both institutions have set a 2025 gold price target of $3,500, highlighting escalating tariff uncertainty and geopolitical instability as key drivers.

- J.P. Morgan: Forecasts gold prices to rise toward $3,000 per ounce in 2025, with a Q4 2025 quarterly average of $2,950.

- Deutsche Bank: Projects a gold price range of $2,450 to $3,050 per ounce for 2025, considering various economic scenarios.

- State Street Global Advisors: Anticipates gold to range between $2,600 and $2,900 in 2025, with potential to rise to $3,100 under certain economic conditions.

Geopolitical & Economic Drivers

- Tariff Impacts: President Donald Trump’s tariff policies have introduced significant volatility into global markets, prompting investors to seek safe-haven assets like gold.

- Federal Reserve Stance: Chair Jerome Powell has indicated that the Fed will maintain current interest rates while assessing the economic impacts of tariffs, acknowledging potential challenges ahead.

- Global Conflicts: Ongoing conflicts in Ukraine and the Middle East have further increased demand for gold as a secure investment amid geopolitical tensions.

Risks & Contrarian Views

- Morningstar’s Perspective: Analyst Jon Mills predicts a potential 38% decline in gold prices over the next five years, possibly falling to $1,820 per ounce, due to anticipated increases in gold production and waning demand.

- Market Saturation Concerns: The proliferation of gold-based funds and increased M&A activity in the gold sector may indicate a nearing peak in the market, suggesting caution for new investors.

Inflation, Interest Rates & Currency Trends

- Interest Rate Cuts: The Federal Reserve’s interest rate cuts in 2024 have made gold more attractive compared to interest-bearing assets, contributing to its price increase.

- Interest Rate Sensitivity: Gold’s price is sensitive to shifts in interest rates, often moving inversely to bond yields.

- Currency Diversification: Concerns over the U.S. dollar’s status as the global reserve currency have led some investors to diversify into gold.

Portfolio Diversification & Strategic Role

- Liquidity & Credit Risk: Gold is a highly liquid asset with no credit risk, historically preserving its value over time.

- Diversification Benefits: Investing in gold can enhance portfolio diversification, as it often moves independently of stocks and bonds.

- Inflation Hedge: Gold’s role as a hedge against inflation and currency devaluation makes it a valuable asset during periods of economic uncertainty.

Practical Investment Considerations

- Investment Vehicles: Gold can be invested in through various means, including physical gold, ETFs, mining stocks, and futures contracts.

- Gold ETFs: Exchange-traded funds like SPDR Gold Shares (GLD) offer a convenient way to gain exposure to gold prices without the need to hold physical gold.State Street Advisors+4ETF & Mutual Fund Manager | VanEck+4en.wikipedia.org+4

- Gold Mining Stocks: Investing in gold mining companies can provide leveraged exposure to gold prices, though they come with additional risks related to company performance.

- Gold Futures: Futures contracts allow investors to speculate on gold prices, offering potential for significant gains but also carrying higher risk due to leverage.

- Gold IRAs: A Gold IRA allows investors to hold physical gold within a retirement account, providing tax advantages and a hedge against inflation. By investing in a Gold IRA, individuals can diversify their retirement portfolios with tangible assets that often maintain value during economic downturns. This type of investment not only offers potential protection against market volatility but also aligns with long-term financial planning goals.

Final Thoughts: Is Gold a Good Investment Right Now?

As of April 2025, gold has reached unprecedented heights, driven by a confluence of factors including geopolitical tensions, economic uncertainties, and shifting monetary policies. Central banks have continued to bolster their reserves, with significant purchases contributing to the metal’s upward trajectory. Institutional investors, such as hedge funds, have also increased their exposure to gold, viewing it as a hedge against inflation and market volatility. Analyst forecasts remain optimistic, with projections suggesting further gains in the coming months.

However, it’s essential to approach gold investment with a balanced perspective. While the current environment supports its role as a safe-haven asset, potential risks include policy shifts, changes in inflation expectations, and fluctuations in demand. Investors should consider their individual financial goals, risk tolerance, and investment horizon when evaluating gold as part of their portfolio.

In summary, gold presents a compelling case as a strategic component in a diversified investment portfolio, particularly in times of economic uncertainty. As always, conducting thorough research and consulting with financial advisors can help ensure that investment decisions align with personal financial objectives.

Is gold a good investment in 2025?

Yes, gold has reached record highs in 2025, driven by factors like geopolitical tensions, economic uncertainties, and strong demand from central banks and investors. Analysts forecast continued strength in gold prices, making it a compelling investment option this year.

Why are gold prices rising now?

Gold prices have surged due to escalating trade tensions, particularly between the U.S. and China, leading to increased tariffs and market volatility. Investors are turning to gold as a safe-haven asset amid these uncertainties.

What are the benefits of investing in gold?

Gold offers several benefits:

Inflation Hedge: Protects against currency devaluation.

Diversification: Reduces portfolio risk due to low correlation with other assets.

Liquidity: Easily bought and sold in various forms.

Safe Haven: Preserves wealth during economic downturns.

What are the risks of investing in gold?

While gold is a stable asset, it can be subject to price volatility. Additionally, investing in physical gold involves storage and insurance costs. Market factors, such as changes in interest rates and currency strength, can also impact gold prices.

How can I invest in gold?

You can invest in gold through:

Physical Gold: Coins, bars, and jewelry.

Gold ETFs: Funds that track gold prices.

Gold Mining Stocks: Shares in companies that mine gold.

Gold IRAs: Retirement accounts holding physical gold.

What is a Gold IRA?

A Gold IRA is a self-directed individual retirement account that allows you to invest in physical gold and other precious metals. It offers tax advantages similar to traditional IRAs and can provide a hedge against inflation.

Are there tax benefits to a Gold IRA?

Yes, Gold IRAs offer tax-deferred growth, meaning you won’t pay taxes on gains until you withdraw funds. Roth Gold IRAs allow for tax-free withdrawals in retirement. However, early withdrawals may incur penalties.

How much of my portfolio should be in gold?

Financial advisors often recommend allocating 5-10% of your investment portfolio to gold. This allocation can provide diversification benefits without overexposing you to the risks associated with gold price fluctuations.

Is it too late to invest in gold in 2025?

While gold prices are high, many experts believe there’s still potential for growth due to ongoing economic uncertainties and inflation concerns. However, it’s essential to assess your financial goals and consult with a financial advisor before investing.

What are the best gold investment options in 2025?

Some top gold investment options include:

SPDR Gold Shares (GLD): A popular gold ETF.

iShares MSCI Global Gold Miners ETF (RING): Focuses on global gold mining companies.

Physical Gold: Coins like the American Gold Eagle or Canadian Maple Leaf.